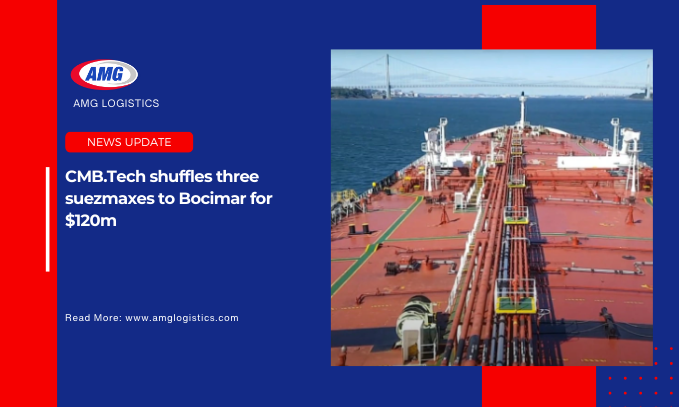

CMB.Tech, the dual-listed green shipping company focussed on decarbonisation borne from tanker owner Euronav, has announced the sale of three suezmax tankers to CMB-owned Bocimar.

The three ships were built in 2007-08 and formed part of the Euronav fleet: Selena, Cap Victor, and Cap Felix. The shuffle of assets within CMB’s controlled entities aligns with CMB.Tech’s current company strategy – the diversification, decarbonisation, and optimisation of its fleet.

The average age of the ships is 16.6 years, well above the CMB.Tech fleet’s average of 4.3 years, and the ships are among the oldest of its suezmaxes. Their average annual efficiency ratios ranging from 2.96 to 3.77 grams of CO2 per tonne-nautical mile exceeds the CMB.Tech crude oil tanker fleet average of 2.46 g.

CMB.Tech’s fleet will also have a leg up on the sold vessels in certain charter negotiations. As part of the CMB’s acquisition of CMB.Tech earlier this year, CMB.Tech secured priority for its vessels over CMB ships should they compete for a charter of over three months in length. The agreement is in place until February 2034 and extends to the Bocimar fleet and tanker markets.

The suezmax sale prices were arrived at after consulting Braemar and VesselsValue, taking the highest aggregate price of $119.5m. The figure was above the $114m from Arrow Valuations, a benchmark sought by a committee of independent members of the CMB.Tech supervisory board, Julie De Nul, Catharina Scheers, and Patrick Molis.

Bocimar will pay a further $530,860 to cover the ballast voyage of Selena to Balboa for delivery.

The committee said it had been informed by the management board that CMB.Tech had “attempted to sell some of its similar conventional crude oil tanker vessels on the market over the past few months in the period from July until November 2024, in line with its strategy. However, the company has not received satisfactory offers.”

Indicative offers of $34m to $37m per vessel were received, lower than the price Bocimar was willing to pay, and the $38.2m secured for Selena, $39.0m for Cap Victor, and $42.3m for Cap Felix.

Buyer Bocimar has waived its right for inspections, and will take delivery of all three ships this month, when two of the ships will be off-hire and the third in drydock. The dry bulk operator told CMB.Tech that it has confidence in the medium-term potential of the suezmax market, while the seller wants to reinvest its capital in decarbonised ships rather than wait for the market to rise.

CMB.Tech shares have marched downwards in recent months, falling from a peak of $17.36 on October 7, 2024, to $10.34 at the last close on December 6. The court-ordered re-opening of CMB’s takeover bid for CMB.Tech (then Euronav) in November ended in the tendering of 1,579,159 shares into the offer, which at the time of its opening was a poor deal advised against by the CMB.Tech board.

When the tender opened on 23 October 2024, the $12.66 per share offer was below the prior day’s close of $16.04. By the end of the tender period on November 21, the NYSE price had fallen to $11.38. CMB owns over 80% of CMB.Tech shares, and over 90% of voting rights.

The suezmax sales will generate a capital gain of $70.9m for CMB.Tech, with net profits of $70.9m across all three divestments, and net proceeds of $62.1m. Funds from the sales will be used to repay debts on the vessels, with proceeds used to fund CMB.Tech newbuilds and/or advances on potential future vessel orders.